Root Inc. is a technology-driven insurance company that has set out to transform the auto and renters insurance industry. Unlike traditional insurers that rely on broad demographic factors like credit scores, age, and ZIP codes to determine premiums, Root uses telematics and artificial intelligence to assess how individuals actually drive. By leveraging smartphone data, the company offers personalized insurance rates that reward safe driving behaviors.

Since its founding in 2015, Root has expanded its presence in the insurtech space, attracting both enthusiastic investors and skeptics. While its innovative approach has earned praise, challenges such as high customer acquisition costs, underwriting losses, and stiff competition from established insurers raise important questions about its long-term viability. For investors considering Root as a potential opportunity, it is crucial to evaluate the company’s business model, financial health, market position, and risk factors.

Company Background and Leadership

Root was founded in Columbus, Ohio, by Alex Timm and Dan Manges, with the vision of making insurance pricing fairer and more accurate through data science. Alex Timm, who serves as CEO, has been a strong advocate for telematics-based insurance, arguing that traditional pricing models often penalize responsible drivers based on irrelevant factors like credit history.

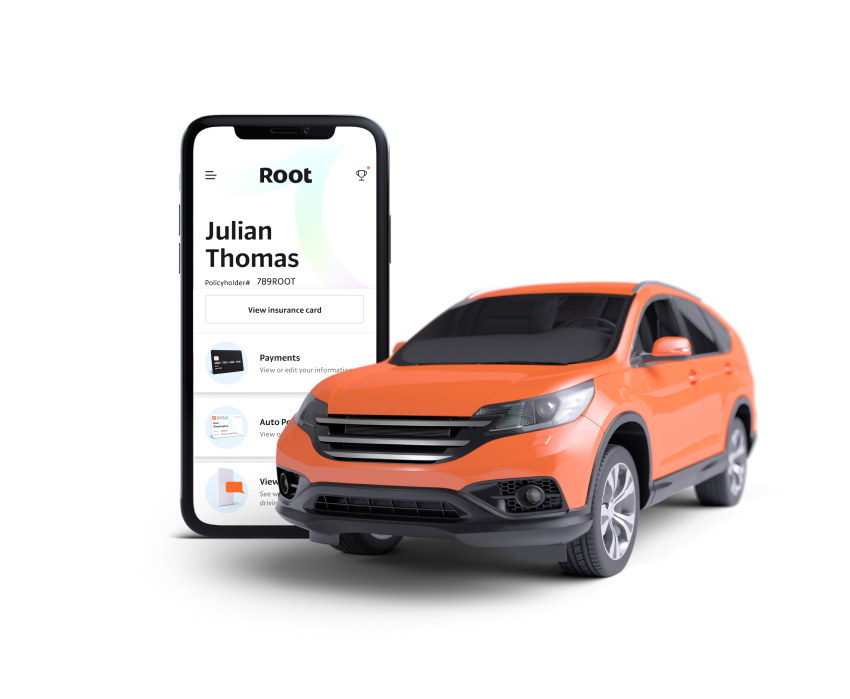

The company launched its flagship auto insurance product in 2016, allowing users to download an app, drive for a few weeks while their habits are monitored, and receive a personalized quote based on their actual driving behavior. This model helped Root differentiate itself early on, appealing particularly to tech-savvy consumers looking for a more transparent and fair insurance process.

Root went public in October 2020, amid strong investor interest in disruptive technology companies. However, its stock has since struggled, reflecting both the volatility of the insurtech sector and broader concerns about the company’s profitability.

How Root’s Business Model Works

At the heart of Root’s business is its telematics-driven pricing model. Instead of setting rates based on static factors like age or credit score, Root collects real-time data through its mobile app. The app tracks behaviors such as hard braking, rapid acceleration, sharp turns, and phone usage while driving. After analyzing this data, Root assigns a driver score and determines the policy price accordingly.

This approach allows the company to attract safer drivers who are likely to generate fewer claims, which in theory should lead to lower loss ratios over time. In addition to auto insurance, Root offers renters insurance and has entered into strategic partnerships to provide embedded insurance options. For example, its partnership with Carvana allows customers to purchase auto insurance seamlessly when buying a car online.

Despite these innovations, Root faces several challenges in scaling its model. Convincing drivers to download an app and allow tracking can be a hurdle, especially for customers who are skeptical of data privacy issues. Additionally, while the company initially focused on attracting low-risk drivers, maintaining a balanced risk pool is essential for long-term financial stability.

Market Position and Competition

The auto insurance industry is highly competitive and dominated by well-established players such as State Farm, GEICO, Progressive, and Allstate. These companies have decades of underwriting experience, large-scale brand recognition, and strong customer loyalty. While Root’s AI-driven model offers differentiation, competing with these giants remains a formidable challenge.

Beyond traditional insurers, Root also faces competition from other insurtech firms, such as Lemonade, which has disrupted the home and renters insurance space, and Metromile, which offers pay-per-mile auto insurance. The broader insurtech sector has been characterized by rapid innovation but also significant financial losses, as many companies struggle to turn growth into profitability.

Root’s direct-to-consumer model eliminates the need for agents, which helps lower distribution costs. However, this also means the company must invest heavily in digital marketing and customer acquisition, which has weighed on its financial performance. High customer churn and acquisition costs have been ongoing concerns for investors.

Financial Performance and Stock Overview

Root’s financials reflect both growth potential and ongoing struggles with profitability. Since its IPO, the company has experienced significant revenue growth but has yet to achieve sustainable profits.

In fiscal 2025, Root saw an increase in direct written premiums and customer retention rates, indicating some progress in stabilizing its business. However, its loss ratios—representing the percentage of claims paid out relative to premiums collected—remain higher than those of traditional insurers. Improving underwriting accuracy and claims management will be critical to the company’s path to profitability.

Since debuting at $27 per share in 2020, Root’s stock has faced volatility, trading well below its IPO price in recent years. The decline reflects broader concerns about the insurtech sector, as well as skepticism about Root’s ability to scale profitably. The company has taken steps to strengthen its balance sheet, including cost-cutting measures and strategic partnerships, but investor confidence remains mixed.

Root has also pursued embedded insurance deals to drive more cost-effective customer acquisition. The partnership with Carvana, for example, allows the company to integrate insurance offers directly into the car-buying experience, reducing reliance on expensive digital marketing campaigns. Whether such partnerships can meaningfully improve unit economics remains to be seen.

Risks and Investment Considerations

Profitability Challenges

One of the biggest concerns for investors is Root’s ability to reach profitability. While revenue has grown, high claims costs, marketing expenses, and customer churn have made it difficult for the company to break even. Many investors are watching closely to see whether Root can improve its underwriting model to lower loss ratios and improve margins.

Competitive Pressures

Competing with legacy insurers is an uphill battle. Established companies have the advantage of vast resources, brand trust, and decades of claims data. Even if Root’s technology is superior in assessing risk, convincing customers to switch from well-known providers remains a challenge.

Regulatory Uncertainty

Insurance is a highly regulated industry, with different rules varying by state. Changes in regulations or new restrictions on telematics data usage could impact Root’s ability to operate effectively. The company must navigate complex compliance requirements while maintaining its digital-first approach.

Macroeconomic Factors

Broader economic conditions, including rising interest rates and inflation, could impact consumer spending patterns. If economic pressures lead to a decrease in car purchases or an increase in claim costs, Root’s financial outlook could be affected.

Future Outlook

Root’s long-term success will depend on its ability to refine its pricing models, improve claims management efficiency, and expand partnerships to lower customer acquisition costs. The insurtech space remains a high-risk, high-reward sector, with many companies struggling to balance growth and profitability.

If Root can successfully lower its loss ratios while maintaining growth, it could establish itself as a sustainable competitor in the insurance market. However, given the intense competition, regulatory risks, and profitability challenges, investors should carefully weigh both the potential upside and the risks before making an investment decision.

For investors, Root presents both an opportunity and a risk. Those who believe in the long-term potential of insurtech and Root’s ability to improve its unit economics may see value in the company at its current valuation. However, for risk-averse investors, the uncertainties surrounding profitability and market competition make it a challenging investment.

Root Inc. represents an ambitious attempt to disrupt the traditional insurance industry with technology and data science. While its telematics-driven pricing model offers differentiation, the company faces significant hurdles in scaling profitably and competing with established insurers.

This is not financial advice.